Eligibility Verification Services

Our Eligibility and Benefits Inquiry system enables health care professionals to request patient eligibility status instantly and securely. Making your daily interactions with us convenient and easier.

Find benefits information with ease; we include all these information right on your eligibility inquiry:

Member ID, group number, and plan number/plan name

Active coverage, original effective date of coverage or termination date

Insurance type and product type

Access to a patient’s digital member ID

Detailed financial information, including remaining, deductible, co payment and coinsurance for individual and family levels

Lifetime, annual maximum and remaining dollar amounts

Exclusions, plan limits and remaining amounts

Coordination of benefits (COB) information, wherever applicable.

Four Easy Ways to Check Patient Insurance Eligibility

1: Insurance Websites

One of the simplest methods is to go directly to payer portals. Insurance companies like Blue Cross Blue Shield, Aetna, or United HealthCare allow providers to enter information directly into their portal. Look for “Member Services” or “Provider Portal” to find the payer’s eligibility and benefits tools

2: Through a Clearinghouse

If your practice management system accepts many different insurance plans and providers, you may want to explore more centralized options. Tools like Availity, pVerify make it possible to check a larger number of payers in a single portal. This allows providers to get information from multiple payers in one place rather than operating in multiple different portals or websites

If you use a clearinghouse to submit your claims to insurance companies, it’s likely your clearinghouse has some sort of eligibility verification tool. This process may not go deep enough to give you detailed benefits, but you will get at least the basics of what you need for eligibility verification.

3: Check eligibility through your software

Practice Management System (PMS) can check a patient’s eligibility before their visit or generate an eligibility check instantly if you need a quick response. PMS can provide a detailed verification of eligibility so you can provide coverage and co pay information to your patients immediately.

4: Call the Payer

If you’re more old school, you can call the payer directly. Most often you will get the payer’s interactive voice response system (IVR). This is an automated system when you call an insurance company. This IVR will go through a list of questions to confirm information to provide the basics of that member’s eligibility.

It is possible to speak with a human at an insurance company. However, this takes an enormous time if you consider hold times are incredibly long. Most insurance companies aren’t putting many resources here, so expect hold time to continue to increase.

If you want to learn more about Techverce and real-time eligibility checks, schedule a demo now.

Prior Authorization Services

Prior Authorization (PA), sometimes referred as “pre-authorization,” is a requirement from your health insurance company that the doctor should obtain approval from your plan before it will cover the cost of a specific medicine, medical device and/or procedure.

Medical billing prior authorization involves payers covering prescribed services before they are rendered, providing protection for healthcare providers and patients. Techverce pre-authorization representatives are well trained with the most up-to-date payor requirements so that the process is more efficient and prompt.

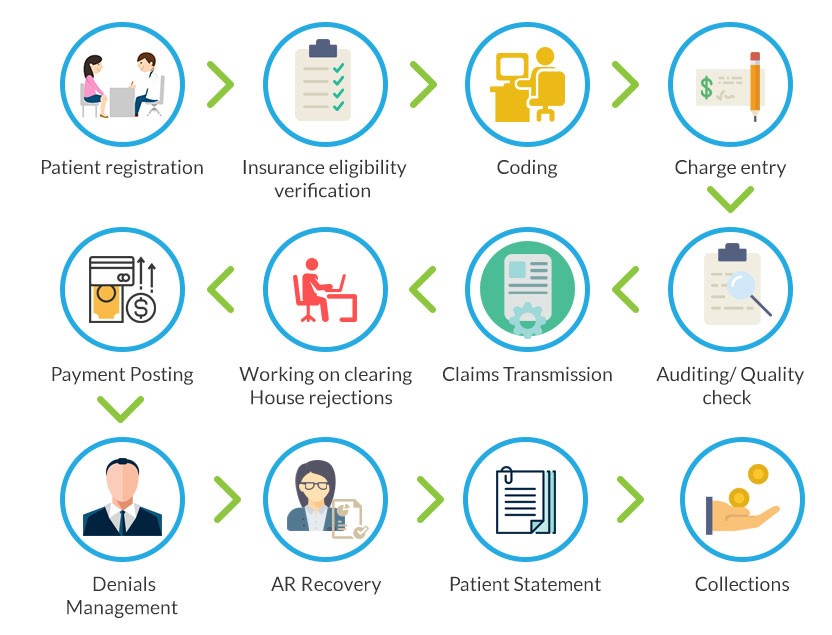

Prior Authorization services in healthcare is a step in the revenue cycle management process. This comes after the Insurance eligibility verification process. The output from the benefit verification process forms the base for the prior authorization process. Prior Authorization in Medical Billing helps the healthcare organization in an appropriate payment collection for the services rendered, reducing denials and follow-up on the same.

Patient Demographic Entry Services

Patient demographic data refers to all of the non-clinical data about a patient, including: name, date of birth, address, phone number, email address, sex, race, etc.

The most tedious task in healthcare is not the care provided but the payment collection. Many factors can result in claim denials. One factor that greatly impacts medical billing is patient demographics. This is important to providers to provide the best care and services possible to their patients. Understanding their patients and their unique backgrounds and needs helps fulfill this purpose. The information collected from patients gives a greater understanding of their needs and preferences, ultimately helping you provide better care while choosing the most effective treatment methods.

Important of Patient Demographics

Patient demographics are essential components of healthcare administration, offering significant benefits to providers, administrators, and patients. From accurate medical coding and billing to personalized care and improved patient safety, collecting and using patient demographic data enhances the efficiency, quality, and security of healthcare delivery.

What does Patient Demographics include?

Patient demographics play a crucial role in the healthcare industry, particularly in medical billing. Healthcare providers and medical billing professionals rely on accurate and up-to-date demographic information to ensure proper reimbursement for services rendered. This might include, but is not limited to:

-

Name

-

Gender

-

Ethnicity/race

-

Date of Birth

-

Address

-

Social Security number

-

Contact Information

-

Drug/ allergies Information

-

Medical History

-

Surgical History

-

Medical conditions

-

Family medical history

-

Current medications

-

Insurance provider

-

Employment / employer info

-

Education history

Conclusion

From accurate medical billing and coding to personalized care, effective communication, and improved patient safety, patient demographic data can enhance patient care. By recognizing the importance of patient demographic data and leveraging its benefits, healthcare organizations can optimize their operations, enhance patient outcomes, and provide patient-centered care in today’s complex healthcare landscape.

Techverce today to take your patient experience to the next level. With our cutting-edge cloud-based solutions paired with a skilled team, you can rest assured that all your claims are getting reimbursed quicker than ever.

Charge Entry and Charge Audit Services

Charge entry and audit services are integral parts of the medical billing process that ensure an uninhibited cash flow, fewer delays in payments delays, lesser instances of claim denials, and ensure compliance of a healthcare enterprise to the gold standard regulatory and ethical frameworks.

A healthcare provider is required to take approval from the insurance firm prior to treating a patient to get done with claim submission for reimbursement; the billed amount also termed as the charge amount refers to the charges against all the services provided by the healthcare giver and were included during the charge entry process; a super bill is a comprehensive constitution of services and diagnostic bills and form listing procedures that record all the medical services offered to patients in every visits. This information is critical to constitute an error-free claim filing to facilitate an appropriate reimbursement for the healthcare provider from the insurance giver.

What are Auditing Services in the Medical Billing Process?

Techverce, Medical billing company with over a decade long experience and proficiency in providing medical services to the leading names in the healthcare sector. Our services are aimed at supporting you in finalizing an accurate reimbursement amount that would be conveyed to the insurance provider for a particular patient. We have earned global recognition in the charge entry services and audit services fields as our team of experts have in-depth insights into workflow solutions that foster error-free medical billing charge entry services. Our streamlined workflow solutions help you achieve about 40% reduction in the overall operational expenditure.

Medical Coding and Audit Services

Identifying and rectifying coding errors is crucial to ensure accurate payment, minimize claim denials, and maximize reimbursement. Our team is adept at spotting shortcomings and promptly addressing them, guaranteeing optimal revenue generation. Your organization can improve its coding processes by using our knowledge and learning from our experts. This improvement will lead to better financial results and increased revenue

A Coding Audit is an internal or external review of a medical office’s coding practices conducted by reviewing patient medical records. Medical record audits target and evaluate procedural and diagnosis code selection as determined by physician documentation for completeness and accuracy.

Scope of Coding Audits

A coding auditor looks at several factors in medical office claims, including:

Assess the proper use of CPT codes

Determine the correct places of service

Look for missing and/or incorrect use of modifiers

Detect incorrect diagnoses (i.e., does not indicate medical necessity)

Identifying coding and documentation accuracy, trends, and deficiencies (if any)

Verify if supporting documentation is adequate to describe the care provided to the patient

Identify any bundling or cluster issues (CCI edits and LMRP)

Determine if services are reasonable and necessary

Results from the audit are discussed in terms of coding accuracy. Consistent accuracy rates of 95% or higher for physicians are recommended by the HHS Office of the Inspector General (OIG).

Techverce helps healthcare providers improve their coding practices by offering comprehensive coding audits and improvement services. This helps with accuracy, documentation, revenue, coding risk, and compliance.

Remittance Processing Services

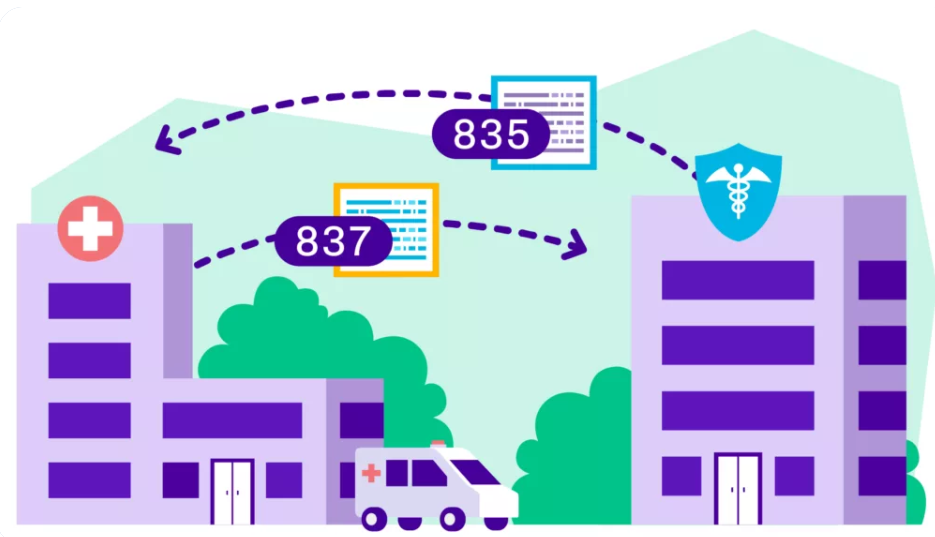

An electronic remittance advice, or ERA, is an explanation from a health plan to a provider about a claim payment

Remittance is the process of sending a sum of money back to a person or organization electronically. In Healthcare claims, remittance usually refers to the process of insurance providers sending back payment to a hospital. Remittance is an integral part of the revenue cycle, but it can lead to problems if the EFT (electronic funds transfer) is deposited in the wrong account by the payers, leading to imbalanced books that take hundreds of work hours a week to untangle.

Receiving files electronically does not equal automation. These files still require staff to manage the actual remittance and reconciliation process. RMS provides true automation that reduces errors and increases efficiency.

Lockbox Services:

Techverce promptly captures and processes all envelopes, records payments, and electronic bill payments from your customers and initiates deposits into your accounts. Our value-added wholesale, retail, and electronic lockbox services provide a single, dedicated location where all your check payments can be received. And, it relieves your staff of the time-consuming tasks of opening received mail, preparing deposits, and delivering them to the bank.

Account Receivable Services

There are many moving parts in your practice’s revenue cycle management (RCM). But one of the most critical components is your accounts receivable, or A/R. Tracking and improving accounts receivable in healthcare is crucial for building a thriving, financially strong practice.

Accounts receivable in healthcare (A/R) are the invoices or reimbursements owed to a medical practice, hospital or other healthcare company. These unpaid accounts may include outstanding patient invoices or insurance company reimbursements.

Your practice bills a patient or submits a claim to a health insurance company, the A/R process begins. After the patient pays the invoice or the insurance company reimburses your practice, the account is no longer in A/R.

In healthcare RCM, usually categorize A/R based on age, usually in 30-day buckets:

- 1-30 days

- 31-60 days

- 61-90 days

- 91-120 days

- 120+ days

Maintaining healthy accounts receivable in healthcare means tracking a few critical RCM key performance indicators (KPIs). These include:

Average days in A/R – This is the average amount of time it takes for patients or insurance companies to reimburse your practice after the appointment date. Our RCM industry experts recommend keeping your average days in A/R to 35 days or less.

A/R > 90 – This is the percentage of A/R that’s older than 90 days or the percentage of invoices or claims that have gone unpaid for 90 days or more. Our RCM experts recommend keeping this to 10% or less.

Denial Management Services

Denial management in medical billing refers to the strategic process of analyzing, correcting, and preventing claim denials. A claim denial occurs when a payer, like Medicare or a commercial health insurance company, declines to honor a provider's request to be reimbursed for medical care.

Denial Management is the process of systematically investigating each denial, performing root cause analysis of why each claim was denied, analyzing denial trends to uncover a trend by one or more insurance carriers, and redesigning or re-engineering the process to prevent or reduce the risk of future claim denials.

Many physician practices forgo thousands of dollars annually in revenue through denied healthcare claims. These denials typically stem from a lack of strong denial management policies and procedures.

Types of Claim Denials

Though all denials result in your physician practice losing out on money you’re owed, they primarily fall under five main categories:

Soft Denial : A temporary or interim denial that may be paid if the practice takes corrective action; no appeal is needed.

Hard Denial : A denial resulting in lost or written-off revenue; an appeal is required.

Preventable Denial : A type of hard denial due to a practice’s action or lack thereof, typically because of registration inaccuracies, invalid codes, and insurance ineligibility.

Clinical Denial : Another type of hard denial, though it is due to lack of payment for medical necessity, an appeal is necessary.

Administrative Denial : A type of soft denial in which the payer notifies the physician practice exactly why the claim was denied; an appeal is possible.

Techverce automate processes in the denial management cycle to streamline your revenue cycle management by identifying patterns of denials and underpayments from payers. Techverce is a far more effective way to increase reimbursement than the outdated manual processes that are so common. Schedule a demo today.

Credit Balance Services

One of the most significant risks in the healthcare revenue cycle is Credit Balance – the excess money received compared to the medical services rendered charges. While there are many reasons for credit balance situations to occur, over-payments from payers and excessive payments could be from deductibles, and co-pays are the primary reasons for credit balance. The healthcare provider must refund such amounts to the appropriate party – payer or patient.

A credit balance is any account in a negative balance, caused by improper or excess payment made to a provider. Though credit balances can represent actual overpayments made by the payer, they often result from preventable billing errors such as improper coordination of benefits, duplicate payments posted, errors calculating coinsurance, and many more.

Patient Credit Balances

Patient credit balances are those caused by improper payments from patients, typically resulting from miscalculating their coinsurance or out-of-pocket costs.

Commercial Payer Credit Balances

Commercial credit balances are caused by improper payments made by commercial insurance payers, often caused by registration errors, improper coordination of benefits, and contract issues.

Medicare/Medicaid Credit Balances

Medicare and/or Medicaid credit balances are improper payments made by government payers, they carry with them the strictest regulation and highest probability of fines and penalties if mismanaged.

Techverce, on the other hand, has built a complete credit balance solution designed to properly resolve all credits (regardless of source or dollar amount) then identify their root-causes and implement corrective actions to prevent them. Discover the complete credit balance solution today by requesting a consultation with Techverce.

A Powerful Analytics & Reporting Platform

Data-Driven Strategic Decisions

Get Real-Time, in-depth analysis and key performance indicators of your organization’s operations.

Get tried-and-tested solutions to help your practice achieve its goals with our state-of-the-art Business Intelligence platform.

Keep up-to-date with all the latest trends, easily spot inefficiencies and discover new opportunities to take your practice’s RCM to the next level.

We provide both pre configured as well as customized reports for your practice and hospital needs. Reporting solutions analytics & reporting Techverce Medical Billing services

Analytics & Reporting

At your convenience, our team can send you weekly or monthly reports of each claim for your practice. Reports will help you to ease your practice needs and they will show you the complete picture of our account.

Offers Free Services For New Clients On Signup

Previous Billing Company’s complete audit report with a summary and detail.

We offer their new client a 30-day free trial.

Weekly practice-based reports shared with Client for the insights about the practice.

We also offer our new clients that if they want to continue using their existing software, we will continue working on their existing software.